The Fed released its G.19 report on Consumer Credit yesterday, and it stirred some optimism (see also here):

The new U.S. consumer credit numbers reflect an economy that is reaccelerating, and that is very bullish for growth — as well as inflation. All in all, U.S. household credit surged by $7.62 billion in February, ramping up faster than at any other time since June 2008.

I respectfully beg to differ. While the story gives a passing nod to the rise in student loans, the fact of the matter is that student loans is virtually the whole story, and the downward trend/trajectory in credit, save that category, has really not reversed.

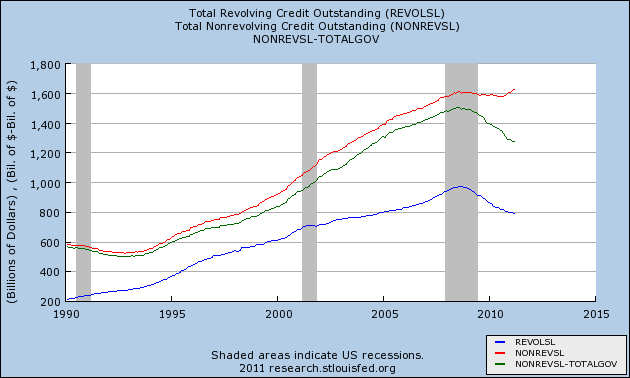

Let’s have a look:

What we’ve got above is Total Revolving, Total Non-revolving, and Total Non-revolving minus TOTALGOV, the category that includes student loans. Without the increase in student loans — which is to say the green line and the blue line — the trend in credit continues downward.

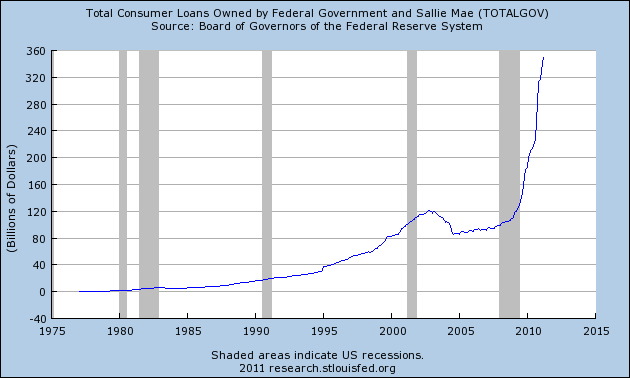

But let’s take a look at exactly how much the TOTALGOV series is goosing non-revolving credit:

It is, quite literally, a reverse cliff-dive.

In short, fade the notion that consumer credit is experiencing some sort of credit renaissance and that happy days are here again.

No comments:

Post a Comment